Impact of Terms of Trade on Turkey’s Current Account Balance

- Posted by admin

- Posted on May 29, 2013

- Competetiveness, Macro Topics

- Comments Off on Impact of Terms of Trade on Turkey’s Current Account Balance

Domestic demand’s rapid growth and the decoupling between domestic and external demand raised the current account deficit significantly in Turkey since 2010. However, developments in terms of trade (TofT) independently affect the external deficits as well. This note analyses analyses the impact of terms of trade on Turkey’s current account balance.

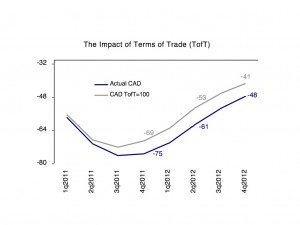

In addition to decoupling between domestic and external demand conditions, the deterioration in terms of trade impacted the current account deficit in 2011. The Central Bank of Turkey pointed out this issue in the first box of the Balance of Payments Reports 2011-II, and released the results of their exercise. We revisited their methodology and recomputed the terms of trade affect on current account balance with 2010 based new foreign trade unit value indices. We have made two important assumptions: First of all, the terms of trade figures recorded in 2010Q3 have not been changed and the level recorded as approximately 100 was maintained throughout 2011 and 2012. Secondly, the constant level of terms of trade would have no impact on supply and demand conditions.

e

e

In line with the framework of this approach, the impact of the deterioration in terms of trade on the current account deficit was approximately 0.8 percentage point of GDP during 2011 when Turkey recorded 9.7% current account deficit to GDP. The terms of trade continued to deteriorate and expanded the current account deficit in the first half of 2012, whereas it improved somewhat in the second half. Consequently, the current account deficit would have declined to USD 41 billion (5.2% of GDP) from USD 47.5 billion (6% of GDP) in 2012 when adjusted for terms of trade. Throughout 2012, 0.8 percentage point current account deficit stemmed from the deterioration in terms of trade.

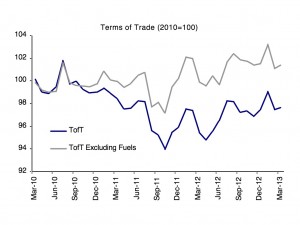

The sub-components of terms of trade, import and export unit value indices are highly correlated with each other. Energy and other commodity prices have big impact on the overall import unit value index. Therefore, the tendency of terms of trade depends on international developments rather than domestic price changes.

Central Bank of Turkey expects an increasing pressure in current account related to recovery in domestic demand, whereas it assumes that weak energy prices in international market will offset that expansion. However, if their expectation regarding weak energy prices fails, we can witness a rapid widening in current account deficit.

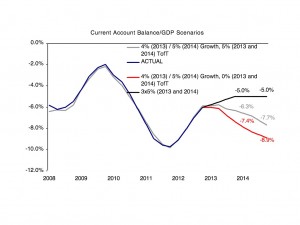

According to our estimates, with 4% GDP growth rate government’s target, current account deficit to GDP can easily rise above 7%, if energy and commodity prices don’t fall, and hence terms of trade doesn’t improve. In order to keep current account deficit stable at 6% of GDP similar to this year, there has to be 5% improvement in terms of trade as GDP grows by 4%. Besides, regarding 3×5% success level referred by CBT Governor Erdem Basci, terms of trade has to increase by 8% while annual inflation and GDP growth rate stay 5% in 2013. Other possible estimation outcomes, which differ according to GDP growth rates and terms of trade changes for 2013 and 2014, also are shown on the graph below.

These exercises show that structural problems creating the current account deficit in Turkish economy are not likely to be overcome soon. While domestic and external demand decouples due to weak external demand, current account deficit depends on the developments of international energy prices. Almost half of this year has expired and energy and other commodity prices have not been raising Turkey’s import bill very much. Yet, the second half of this year and the next year will probably not be similar, and current account deficit may be a challenge again.

In accordance with a long-term view, market and product diversifications in both export and import, and bilateral trade agreements may be the policy options leading to the structural improvement in terms of trade, and hence the resilience of economic structure. Otherwise, Turkish current account balance is going to be vulnerable to short-term fluctuations in international energy and other commodity prices.

- March 2023

- February 2023

- September 2022

- April 2022

- February 2021

- June 2020

- March 2020

- December 2019

- November 2019

- June 2019

- May 2019

- March 2019

- February 2019

- October 2018

- August 2017

- June 2017

- February 2016

- October 2015

- May 2015

- March 2015

- January 2015

- December 2014

- September 2014

- April 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- July 2013

- May 2013

- April 2013