Observations on IMF’s Turkey Estimates

- Posted by Pelin Dilek

- Posted on April 24, 2013

- Macro Topics

- Comments Off on Observations on IMF’s Turkey Estimates

I have always found the IMF reports on Turkey interesting: With a focus on long-term sustainability, the reports are good reminder of what the financial markets might overlook. Because they draw a solid framework on the problems of the Turkish economy, they help to put things into perspective for the financial and real sector professionals investing or thinking-about-investing in Turkey.

These reports are also as candid as they can be: The last consultation 4 review, released in December 2012 wrote openly that fiscal stance in Turkey was too loose; primary surplus should be increased. The report also mentioned that the central bank should normalize the monetary policy framework which required positive real rates.

Needless to say, politicians and bureaucrats sometimes do not agree with some of the things that the IMF says. Yet lately, there has been even some disagreement on the IMF’s Turkey forecasts (IMF’s 2012 current account estimate of around 8% was openly criticized by the CBT officials). And that is when the IMF forecasts hit the news.

Yet, there should be more to these forecasts than this limited press coverage. After all, five-year forecasts on Turkish economy are rare and when these forecasts are made under global macro models as done in the IMF, they can provide insight.

So in order to understand IMF’s perspective on the Turkish economy, I have brought together the forecasts for the last six year’s World Economic Outlook reports (a total of 11 reports). Here are my observations from the time-series data of IMF’s Turkey forecasts on GDP, inflation and current account deficit:

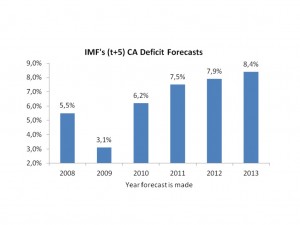

· There seems to be a structural change for the estimates made after 2008 global crisis. Long-term (five-year) growth estimates got smaller, inflation higher and current account higher and more volatile (see graph below).

· While the long-term growth forecasts fell from 5% in 2008 to as low as 3.5% in 2009, they have been gradually increasing since: According to the latest forecasts of April 2013 WEO, IMF visions Turkey’s long-term growth forecast at 4.5%. These longer-term GDP forecasts are probably made based on potential growth estimates; therefore I understand that IMF is now more positive on Turkey’s potential growth rate than it was three years ago.

· A specific year’s growth forecasts can swing quite significantly. 2010 growth estimate is an example: When the IMF first made a post-2008 GDP estimate, 2010 growth rate was penciled in as 1.5%. The latest estimate for 2010 was made during 1q11 as 8.2%. The realized figure turned out to be 9.2%.

· Despite the high degree of volatility in 2010 growth estimates, the 2012 growth estimates are worth-noting for their low volatility. IMF economists were the first to estimate a growth rate in the vicinity of 2% for 2012. The last four WEO report forecast average is 2.5%, which is very close to the realized figure of 2.2%.

· Along the above-mentioned argument, it is worth noting that 2013 GDP forecast have been persistently close to 3.5% in the last four WEO reports.

· Even though growth estimates for a specific year improve (in terms of accuracy) as we move forward, the same thing cannot be said for inflation figures. 2010’s year-end inflation forecasts were 6.5%, 6.3%, 8.4%, 7.6% during the last four WEO reports respectively, prior to the end of 2010. The figure turned out to be 6.4%. The 2012 estimates started as 5.5%, increased to 8.6% and fell to 6.5% just before the announcement of the realized figure of 6.2%.

· IMF economists seem to have noticed the structural change in Turkey’s current account deficit as early as end of 2010. Public took notice of that change when the IMF estimated a current deficit of 8% of GDP 2012 despite halving of the growth estimates from 4.5% to 2.2%. Even though the realized figure turned out to be lower at 5.9% of GDP, the IMF has not changed its mind for the next three years, insisting that the deficit will be over 7% (close to 8%) of the GDP during the next five-year forecast horizon.

Conclusion: Long-Term Forecasts Tell A Story…

Even though IMF’s long-term forecasts do not take much attention, there are things to pick out from them. Despite the swift recovery, Turkey has taken its toll of the Global Crisis as we can observe from the deterioration in the long-term forecasts. On the more optimistic side, IMF is getting more positive regarding Turkey’s long-term growth potential but in the short-term, it believes that GDP growth is likely to stay under potential. Turkey’s post-2008 growth recovery was not depicted by the IMF but it was able to foresee (before anyone else) the structural break in 2011’s current account deficit as well as the need to slow down the economy well below potential in 2012. Despite the correction in the 2012 CA deficit, looking at the IMF’s five-year forecasts, the deficit is here to stay as a burden to the Turkish economy. Last but not least, chicken soup for the soul of Turkey economists: Volatility of food prices and unplanned public price hikes make short-term inflation forecasting almost impossible in Turkey, and IMF is wrong as anybody as else regarding Turkey’s inflation forecasts.

(Bu yazının Türkçesi 24 Nisan 2013 tarihinde www.paraanaliz.com sitesinde yayınlanmıştır)

- March 2023

- February 2023

- September 2022

- April 2022

- February 2021

- June 2020

- March 2020

- December 2019

- November 2019

- June 2019

- May 2019

- March 2019

- February 2019

- October 2018

- August 2017

- June 2017

- February 2016

- October 2015

- May 2015

- March 2015

- January 2015

- December 2014

- September 2014

- April 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- July 2013

- May 2013

- April 2013